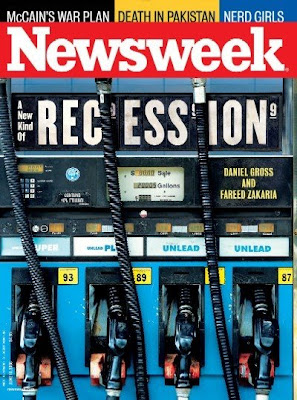

NEWSWEEK Cover: A New Kind of Recession

In the June 16, 2008 issue of Newsweek (on newsstands Monday, June 9), "A New Kind of Recession," Senior Editor Daniel Gross and Newsweek International Editor Fareed Zakaria explain why upbeat forecasts for a quick economic turnaround were wrong and what can pull us out of this financial crisis. Plus: Barack Obama and John McCain's shortlists for vice president, the bizarre side of the Gitmo trial, Tufts University's Nerd Girls and the latest mercenary videogame, Metal Gear Solid 4. (PRNewsFoto/NEWSWEEK) NEW YORK, NY UNITED STATES

8 Jun 2008 17:18 Africa/Lagos

NEWSWEEK Cover: A New Kind of Recession

Changing Our Approach in Handling the Current Financial Crisis Will Be Key to Turning Economy Around

Despite Optimism, Employment Rates, Oil Prices and Market Drops Indicate a Quick Economic Turnaround is Not Likely

NEW YORK, June 8 /PRNewswire/ -- Hopes for a quick economic turnaround were essentially dashed on Friday when the Labor Department reported that American employers axed 49,000 jobs in May, the fifth straight month of job losses, an event that signals a recession and inspired a 394-point decline in the Dow Jones Industrial Average. In the June 16 Newsweek cover package "A New Kind of Recession" (on newsstands Monday, June 9) Senior Editor Dan Gross writes that despite the grim news of a looming recession, hope springs eternal that the second half of 2008 will be better than the first. That is, if we take a different approach than in the past.

(Photo: http://www.newscom.com/cgi-bin/prnh/20080608/NYSU006 )

As it seeks to regain its footing in the second half, the U.S. economy faces two significant obstacles, neither of which was evident in 2001. The first is entirely homegrown: the self-inflicted wounds of the promiscuous extension and abuse of credit in the housing and financial sectors. The second is a global phenomenon that has comparatively little to do with American behavior: rampant inflation in commodities such as oil, food, and steel. These trends have conspired to inflict genuine economic pain and deflate consumer confidence. The Conference Board's Consumer Confidence Index in May slumped to a 16-year low.

"While the treatment of the current malaise has been essentially identical to the reaction to the 2001 slump-aggressive Federal Reserve rate cuts and tax rebates-the symptoms are quite different," Gross writes. "In 2001, an implosion in the technology sector and a slump in business investment pushed the economy over the edge. Even though some 3 million jobs were shed between 2001 and 2003, consumers soldiered on through the downturn. This time, it's the opposite. While businesses -- especially those that export -- are holding up, the economy is being dragged down by the cement shoes of a freaked-out consumer and a punk housing market."

Not all of the news is doom and gloom. For signs that tomorrow really is a day away, look to the thing that got us into this mess: housing. "Housing doesn't have to return to the bubble era. It's just that the rate of decline has to stop," says Lakshman Achuthan, managing director at the Economic Cycle Research Institute. Reductions in the level of housing inventories for sale will be a hopeful sign. Other indicators are the weekly reports on jobless claims, retail chain stores, and mortgage application activity. "This will give you an early read on potential trend shifts in consumption," says Ian Morris, chief U.S. economist at HSBC.

Newsweek International Editor Fareed Zakaria writes in an accompanying column that the period of economic growth for the U.S. has ended and getting the economy back on track will require a great deal of changes. "The policy debate in Washington is focused on the wrong question: how to spark a short-term, cyclical recovery. Congress has already passed a fiscal stimulus bill, and the Federal Reserve has cut interest rates. All we can do now is wait for these policies to have their effect, which they will. The real debate," he writes, "should be about how to move the American economy back onto a high-growth trajectory. It can be done, but it would require large-scale and smart government policies across a whole range of issues."

Zakaria points out that the problems are obvious. The retirement of the baby boomers is going to have a crippling effect on all government budgets -- federal, state and local. Unless entitlements are trimmed substantially, America is headed for fiscal bankruptcy. Immigration policy needs reform, most urgently so that the United States can once again attract the world's most talented people. Spending on research, technology and infrastructure needs a big boost. (U.S. spending on infrastructure as a percentage of GDP is the lowest in the industrialized world today.) Energy policy needs to be overhauled. Trade policy needs to be revitalized. Tax and regulatory codes need to be simplified in order to keep America a competitive place to do business.

"In most of these areas, the solution involves some short-term pain in exchange for long-term gain," Zakaria writes. "But Washington has become incapable of that. Passing a pork-laden bill takes no time. Trimming subsidies, raising taxes or making strategic investments are near impossible." Zakaria concludes that although compromises are hard and no one gets all or even most of what they want, in a "continental land of 300 million, people are going to disagree. No compromise means nothing will get done. And America will slowly drift down in the roll of nations."

As a part of the cover package, Newsweek gathered a number of business experts and asked them to assess the country's current financial situation and offer solutions. Participants included Larry Lindsey, former governor of the Federal Reserve and former economic adviser to President George W. Bush; Robert Reich, secretary of Labor under Bill Clinton; Robert Rubin, Treasury secretary under Clinton, now chairman of the Citi executive committee; Mark Zandi, chief economist of Moody's Economy.com; Bart Van Ark, chief economist of The Conference Board and professor of economics at the University of Groningen in the Netherlands and Marissa Mayer, vice president of search products and user experience at Google.

(Read cover story at www.Newsweek.com.)

Cover

Newsweek's Business Roundtable

Fareed Zakaria: How to Get Back to Growth

Photo: NewsCom: http://www.newscom.com/cgi-bin/prnh/20080608/NYSU006

AP Archive: http://photoarchive.ap.org/

AP PhotoExpress Network: PRN2

PRN Photo Desk, photodesk@prnewswire.com

Source: Newsweek

CONTACT: Brenda Velez of Newsweek, +1-212-445-4078,

Brenda.Velez@Newsweek.com

Web site: NEWSWEEK

Comments